Analysing ECB's Inflation Communication: Insights from Governor Lagarde's Statements and Q&A Sessions.

The article analyses ECB President Christine Lagarde's communication about inflation during the June 2024 meeting using three indices: the Advance Macro ECB Fear Inflation Index, Surprise Inflation Index, and Inflation Topic Index.

Reading time: 6 mins.

In a widely anticipated move the ECB Governing Council decreased interest rates at the June 2024 meeting. But what markets and financial practitioners payed more attention to was Governor Lagarde's communication. In this article, we examine the communication tone of Lagarde under the lenses of three instruments, namely the Advance Macro ECB: Fear Inflation, Surprise Inflation and Inflation Topic Index. These are measures of fear, surprise and overall tone sentiment contained in the ECB's communication about inflation and related topics, respectively.

Constructing the scores: "the approach".

Following the existing literature in the area, we decode the information contained across multiple communication channels (e.g. audio, video and text) to summarise the emotional tone of the meeting. For instance, variation in the voice pitch can be associated to a specific emotion (e.g. surprise), which in turn have been found to impact yields and yield spreads. Borrowing on this literature, the result of our exercise is a set of inflation related scores summarising the sentiment contained in verbal and non-verbal ECB press conference communication.

Given the informal yet operational 'split' between the initial statement and the Q&A press conference session, we examine these two segments separately, thus constructing two distinct scores. In fact, the different modalities of these segments may highlight different characteristics of ECB communication. For instance, during the Q&A session, the governor addresses questions from the audience, making the communication tone naturally less scripted and more conversational. This setting is more likely to reveal the true sentiment of the speaker when addressing specific topics.

In constructing the scores, we further distinguish between two versions: a weighted and unweighted scoring method. The weighted version, by construction, adjusts the raw index scores by a coefficient of attention. The weighting helps in understanding whether a topic received more or less attention (both with respect to other topics and its past), and has the effect of essentially scaling the distribution by the amount of coverage given to a specific topic (as a % of the total coverage). This provides not only a sense of sentiment when discussing inflation and related topics, but also the focus placed on this.

We consider unweighted scores too, since central bank communication might briefly cover topics not yet at the forefront of discussion, but that may be relevant in the future. By considering both weighted and unweighted scores, we get a comprehensive view of central bank communication, capturing both the current priorities and potential future "hot topics" of discussion.

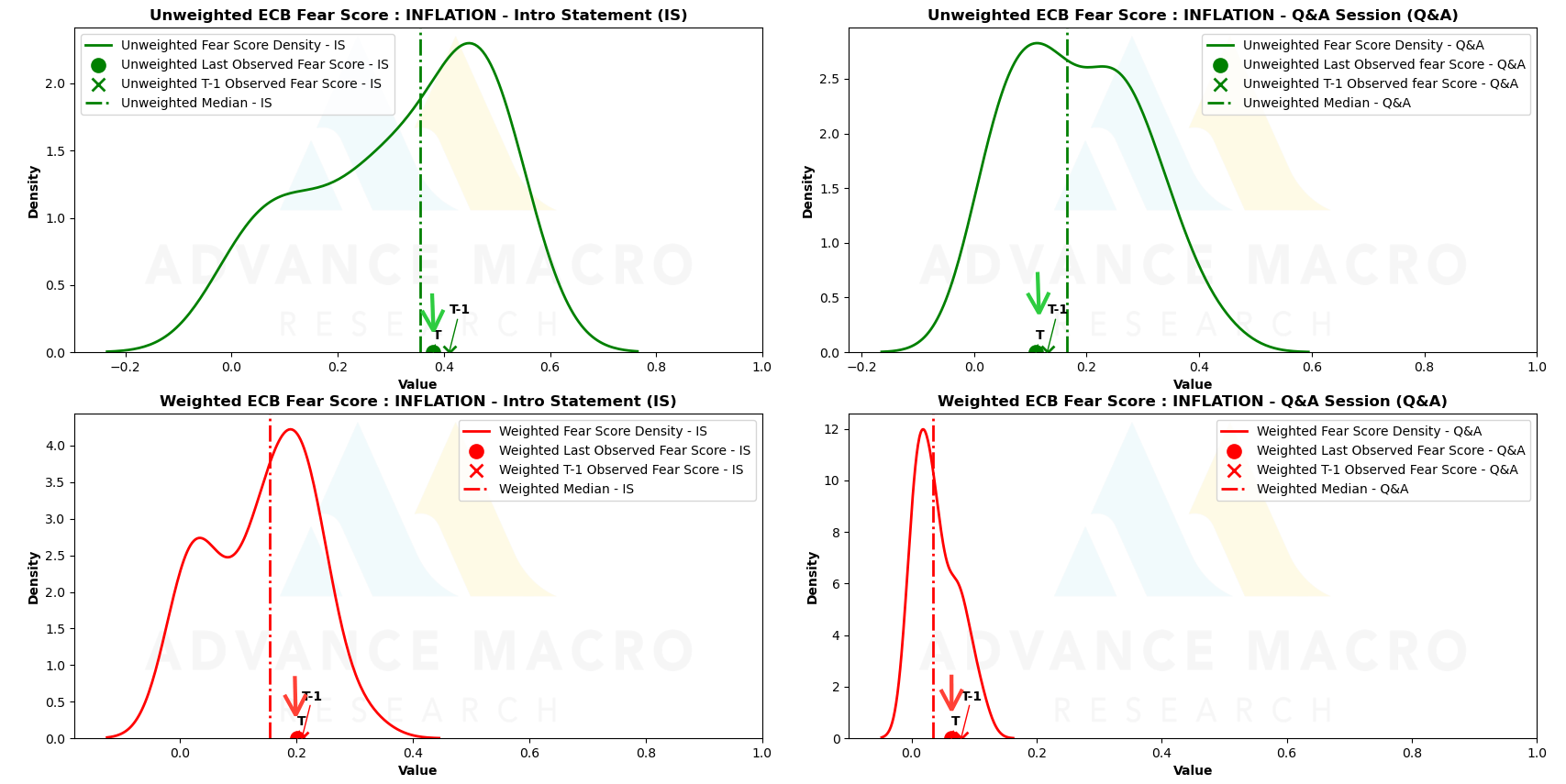

ECB Inflation Fear Scores

Starting with fear scores, Figure 1 below plots the unweighted (top row) and weighted (bottom row) ECB Fear Inflation Score historical distribution along with the latest (most recent) two scores. In this context, an higher score indicates any element that might reflect a state of heightened "fear" in the governor's non-verbal communication. All in all, the results display (albeit slightly), a reduction in "inflation fear", as the green dots and red dots at T (e.g. latest scores) lie to left of the observations at T-1 , e.g. previous scores (Recall: inflation fear increases when the index moves from 0 towards 1).

Further, in 3 out of 4 cases, latest observations (T) are placed somewhat closer to the median, suggesting a shift towards more normal levels of fear in communication. In this context, in defining a "normal level of fear" we assume there is a certain element of inbuilt "steady-state" fear in the communication style and that therefore we only consider deviations from this level as significant shifts. In this setting, closer to the median observations can be interpreted as positive news for market participants, since it reflects lower uncertainty in the future inflation path, something the governor has also remarked repeatedly in her message. However, it is important to reiterate that by historical standards, especially when considering weighted distributions, the fear scores lie still above the median.

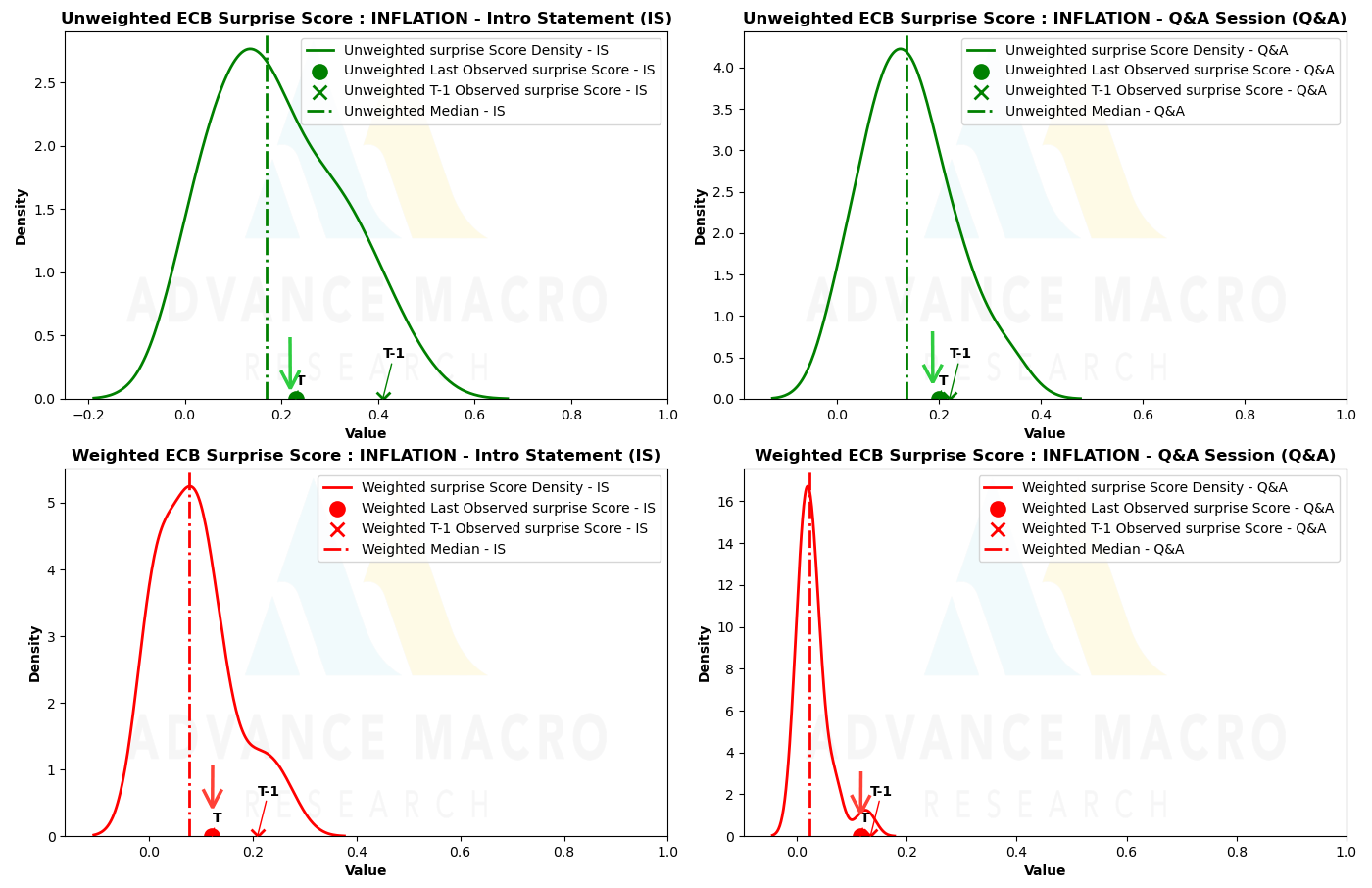

ECB Inflation Surprise Scores

Next, we turn our attention to the ECB Inflation Surprise scores. Following the same logic as above, Figure 2 below shows that a higher score indicates a higher level of "surprise" in the governor's non-verbal communication. The results indicate a significant reduction in surprise during the statement segment, although this reduction is only marginal in the case of the Q&A session.

The reduction in surprise scores in the statement segment can be interpreted as higher confidence in inflation and related topics' developments. In contrast, the slightly reduced scores in the Q&A session can be interpreted as either reflecting relatively higher confidence in the dis-inflation path or more confidence in addressing reporters' questions on these topics. Nevertheless, the weighted Q&A inflation surprise index still reflects historically higher-than-average scores. This might indicate "unexpected" questions from the public and/or an element of surprise when also considering the time allocated to addressing specific elements of communication about inflation and related topics.

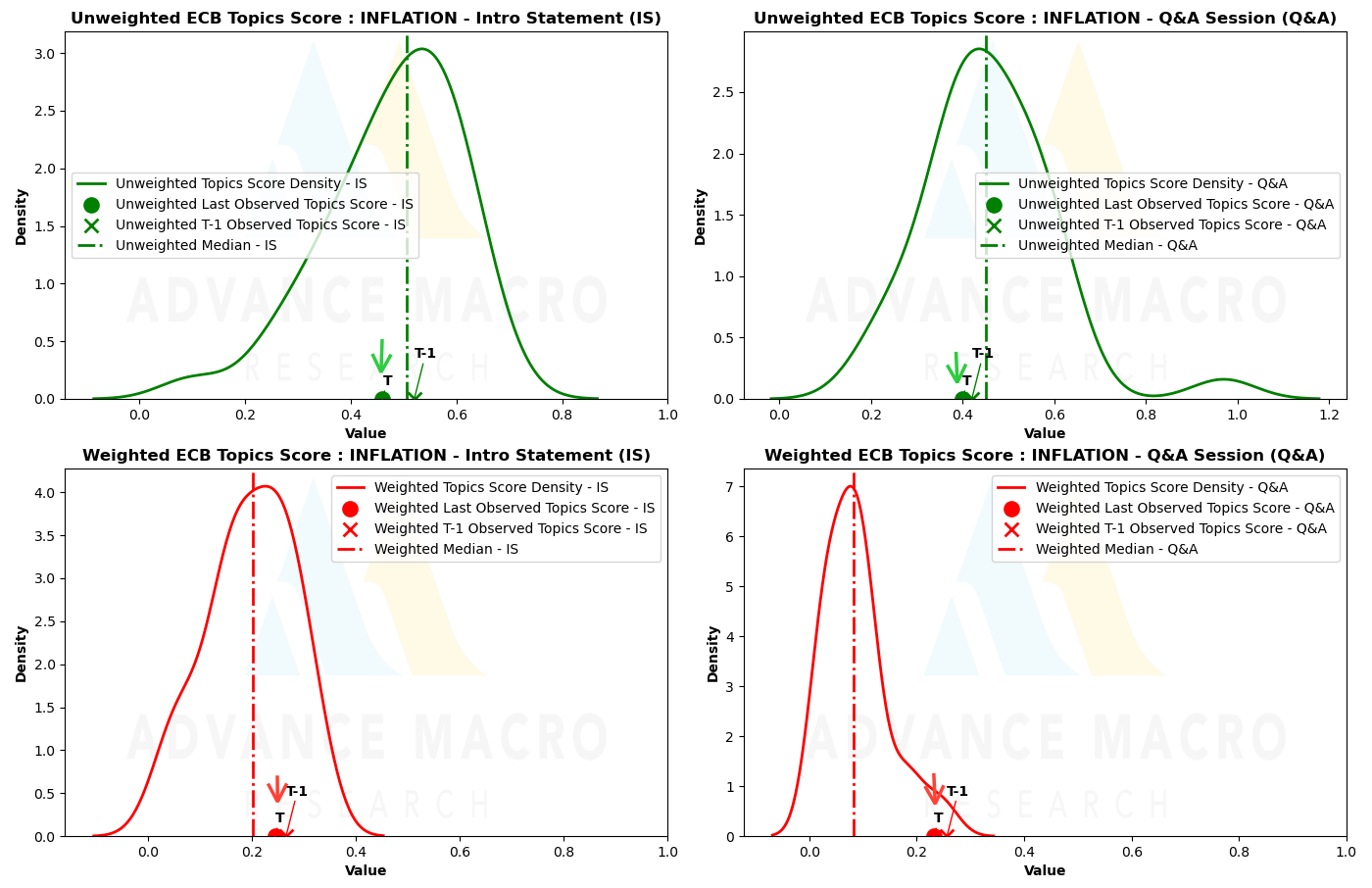

ECB Inflation Topics Scores

Lastly, we discuss the ECB Inflation Topic Score, which constructs the net sentiment of positive and negative verbal and non-verbal communication tone linked to inflation and related themes, see Figure 3 below. The basic idea is that the more positive is the sentiment about inflation, the higher ECB's satisfaction with current inflation dynamics. In this case, we document a marginal deterioration in the most recent unweighted scores (T) vis-a'-vis the previous (T-1). However, when considering weighting by attention scores, inflation topics continue to register more positive than average scores, possibly reflecting growing satisfaction with ongoing dis-inflation developments in the Euro-Area.

Conclusions

Our analysis of Governor Lagarde's communication during the ECB's June 2024 meeting reveals valuable insights into the central bank's messaging on inflation. The results indicate a slight reduction in both fear and surprise elements, suggesting a more confident stance on inflation developments. The overall inflation sentiment as represented by the Inflation Topic scores, while showing a marginal deterioration, remains positive when weighted by attention scores. This highlights growing satisfaction with inflation developments and the economy disinflation path. However, despite the good news, the results also point towards a cautions approach by the ECB, since (weighted Q&A) Inflation Fear scores are still relatively high by historical standards, indicating that inflation worries have not been left behind.

The ECB Fear, Surprise and Topics Scores are part of our Central Bank E-monitor offering. Subscribe today to gain valuable insights into ECB communication.

The Central Bank E-Monitor

Subscribe to our newsletter to receive period updates about the central bank e-monitor.

Disclaimer: The information contained in this article is for informational purposes only and should not be construed as investment advice, financial guidance, or a recommendation to buy or sell any financial instruments. This article does not take into account any specific investment objectives, financial situation, or particular needs of any individual. Before making any investment decisions, you should seek advice from a qualified financial advisor who can take into account your individual circumstances. The authors and publishers of this material expressly disclaim any liability for any loss arising from any reliance on the information provided herein.