ECB Hawk/Dove Score Index (Executive Board Members Speeches) - Update: June 2024

In this latest update of the ECB Hawk/Dove Score Index (speeches) we analyse the latest communication of Executive Board Members of the ECB outside scheduled ECB GC meetings.

In this latest update of the ECB Hawk/Dove Score Index (speeches) we analyse the latest communication of Executive Board Members of the ECB outside scheduled ECB GC meetings.

Scrutinising communication outside scheduled ECB monetary policy meetings can give an indication on the current stance of ECB Executive members. Under the assumption that the stance of board members informs their upcoming voting behaviour, monitoring this Score Index should help predicting the direction of future key ECB rates.

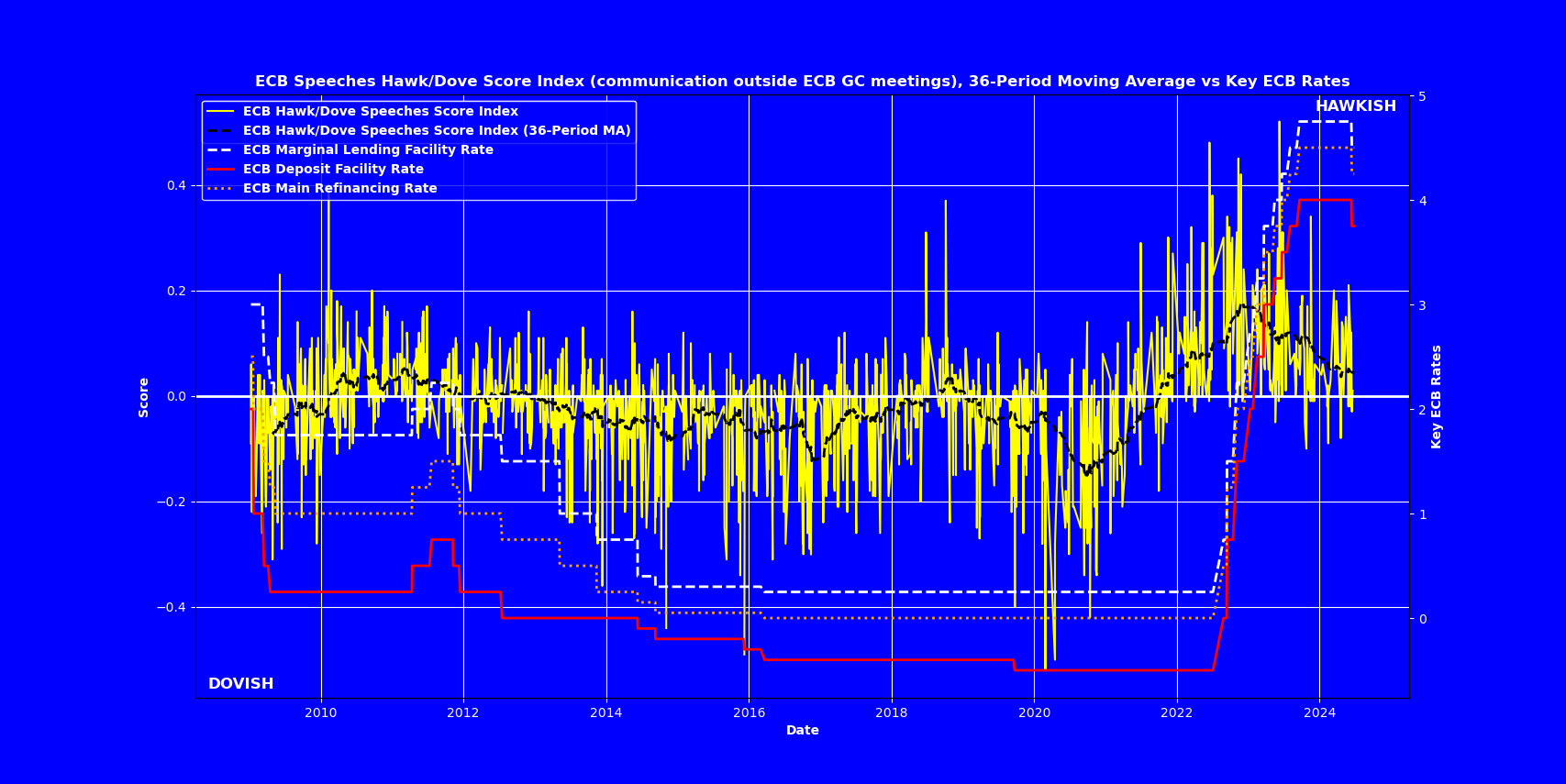

In Figure 1, we plot the Advance Macro ECB Hawk/Dove Score Index (yellow line), the index 36-period moving average (black dashed line), and three key ECB interest rates (MLF, Deposit Facility, and MROR). It is clear that the Hawk/Dove Score points to a relatively more dovish sentiment among ECB Board members compared to the heights of late 2022 (see the 36-period moving average line, dashed black line). This increasingly dovish stance materialized later in key rate cuts at the latest June 2024 ECB policy meeting. However, it is worth emphasizing that the central tendency of the overall scores is still above zero, reflecting the cautious approach of the ECB and the lack of pre-commitment to future monetary policy easing until more data is available.

Exploring Executive Board members' stance: individual members scores

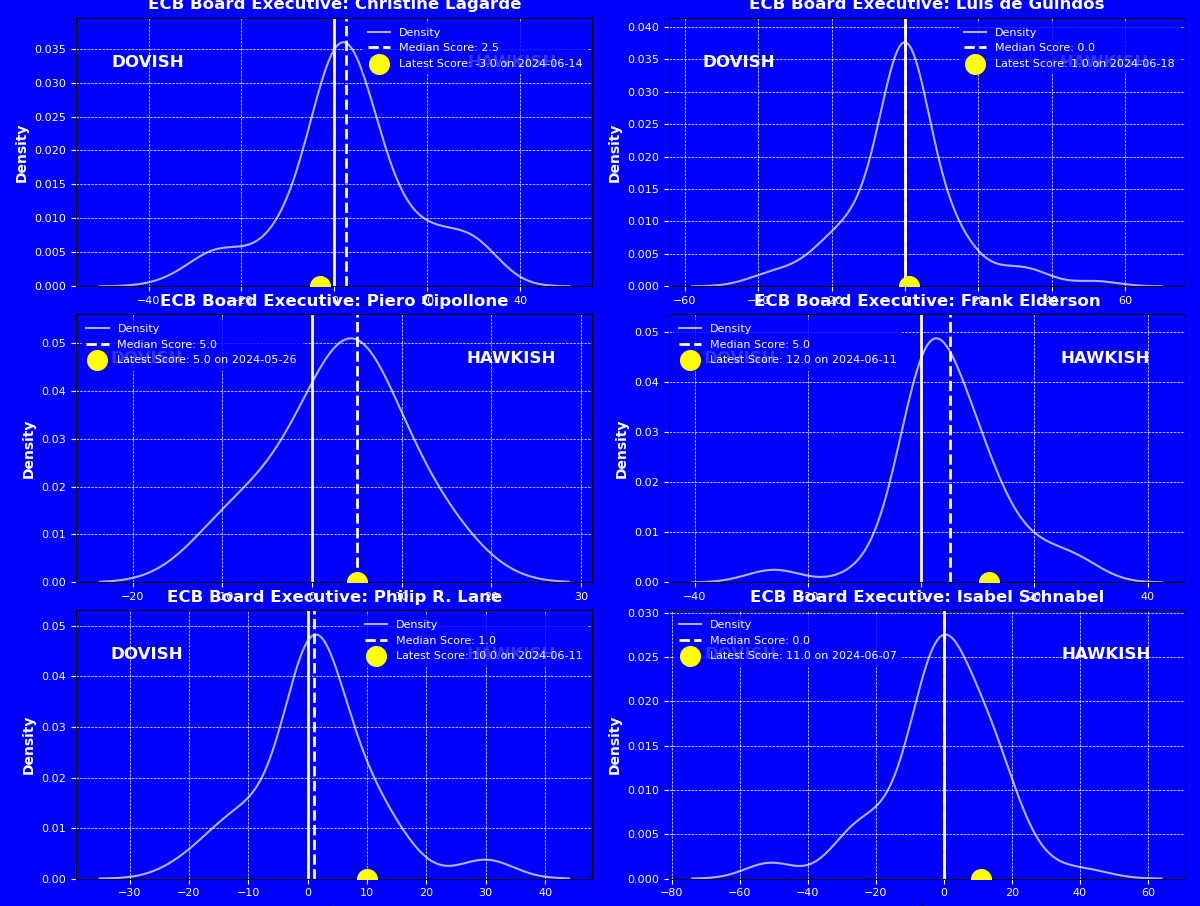

Aggregated scores are useful in understanding the board wide sentiment, however it is also instructive to look at individual scores to gauge the latest sentiment of each executive member. In Figure 2, we plot the latest scores (yellow circle) toghter with the historical distribution of each executive member along with the median (dashed vertical line).

The first thing we can learn from Figure 2, is that historically speaking executive members: Piero Cipollone and Frank Ederson display an hawkish bias. The other members, namely: Christine Lagarde, Philip Lane, Isabel Schnabel and Luis de Guindos have featured historically a neutral stance.

In this setting, if one were to "aggregate" the individual scores in Figure 2, it turns out that the majority would be in favor of a hawkish stance, as 4 out of 6 executive members' speeches featured a score greater than zero. However, in judging the members' monetary policy stance, it is important not to interpret the absolute score but its relative score concerning the historical bias of each member. In other words, how much more hawkish was member "X" compared to their historical standard? From Figure 2, Executive Members Isabel Schnabel, Philip Lane, and Frank Elderson featured scores more hawkish than usual, while the rest were close to their median.

How do we interpret these relatively more hawkish scores?

While the ECB GC cut rates at the last June 2024 meeting, the relatively slightly hawkish stance of the latest Executive Board Members points to a non-change in key policy rates. This suggests that the Governing Council is likely to keep interest rates at the current level. In other words, within the current policy setup, these scores could be interpreted as a higher-for-longer policy. More precisely, the ECB needs stronger evidence of a sustained decrease in inflation towards the central bank target before embarking on a policy normalization path.

Disclaimer: The information contained in this article is for informational purposes only and should not be construed as investment advice, financial guidance, or a recommendation to buy or sell any financial instruments. This article does not take into account any specific investment objectives, financial situation, or particular needs of any individual. Before making any investment decisions, you should seek advice from a qualified financial advisor who can take into account your individual circumstances. The authors and publishers of this material expressly disclaim any liability for any loss arising from any reliance on the information provided herein.